Over the last few years, the market has put a premium on growth, momentum (industry “mumbo jumbo” for buying things that have gone up a lot recently), money-losing companies, passive investing in whatever indices have gone up the most recently, and money-losing IPOs. This environment is the antithesis of our fundamental approach. Consider that, over the last 12 months, buying only money-losing companies would have gained 20-50%. By contrast, for 2015, buying the cheapest value stocks and shorting the most expensive value stocks would have lost 13%. These outcomes are the opposite of what the businesses’ fundamentals dictate. Over the long-run, I do not believe that the current trends are sustainable.

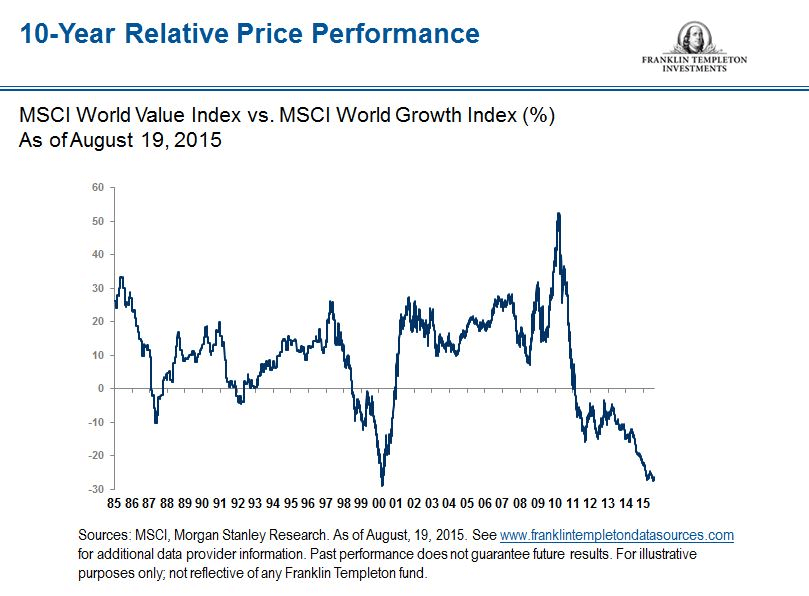

The current period marks the longest duration on record where value has underperformed. Value has not been this cheap relative to growth since the peak of the dotcom bubble. The following table and plot provide some insight into the market’s current behavior.

(Data from Fred Piard)

Despite the current market environment, I believe that the long-term will be kind to our value-investing strategy. As long as I continue to do a good job valuing companies, I believe our effort will be rewarded -- even if it takes some time. In the long-term, the market is efficient and businesses eventually trade around what they are worth. In the short-term, anything can -- and often does -- happen.

Although unpleasant, it is very important that value strategies sometimes underperform in the short-term. Historically, a value strategy underperforms in ⅓ of years and has a 10% chance of underperforming over a 2-year horizon. However, historically, over a 5+-year horizon, value-investing strategies have outperformed >75% of the time. In other words, value investing works, but it doesn’t always work.

We not only expect our value-investing strategy to underperform occasionally -- but more importantly, this fact works to our advantage. If value investing worked every year, every month, every day, and in every market environment, then everyone would be a value investor. If everyone were a value investor, then our opportunities to invest in mis-priced businesses would evaporate. However, the reality is that value investing doesn’t always work (like now). That reality keeps out competition, which allows the strategy to continue to work over the long-term.

Right now, many self-proclaimed value investors have thrown in the towel -- or their investors have thrown in the towel for them. Yes, the market’s current bumpiness is unpleasant, but it is this bumpiness that winnows out our competition. Less competition makes it easier for us to work towards our goal of above-average long-term returns, provided that we stay the course.

David R. “Chip” Kent IV, PhD

Portfolio Manager / General Partner

Cecropia Capital

Twitter: @chip_kent

Nothing contained in this article constitutes tax, legal or investment advice, nor does it constitute a solicitation or an offer to buy or sell any security or other financial instrument. Such offer may be made only by private placement memorandum or prospectus.